As Leading Economic Indicators 2024 takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original. In today’s ever-changing economic landscape, understanding the significance of leading indicators is crucial for informed decision-making and policy formulation.

Exploring the concept, types, impact on policy-making, and future trends of leading economic indicators provides a comprehensive view of what lies ahead in 2024 and beyond.

Leading Economic Indicators 2024

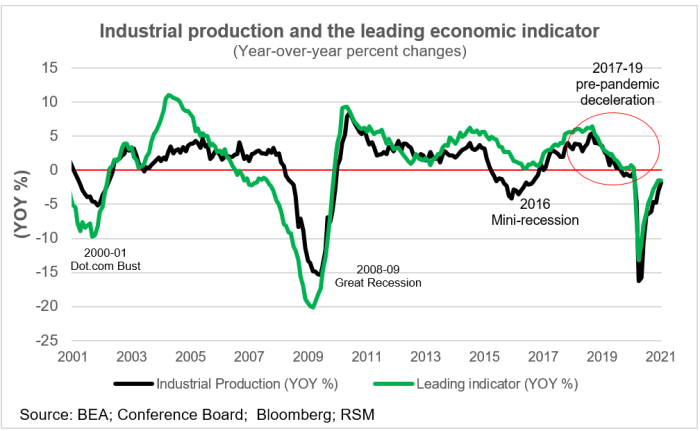

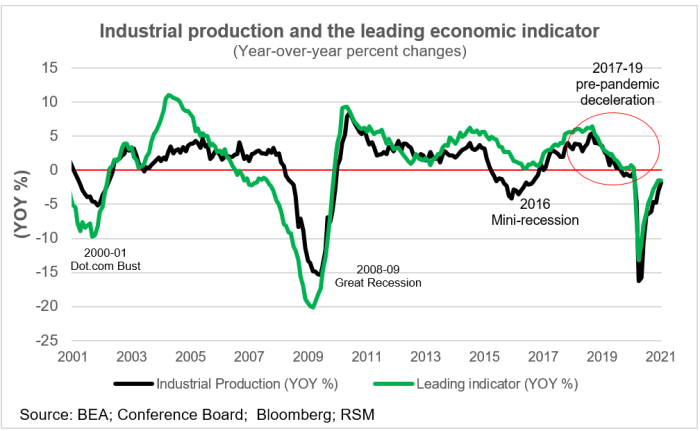

Leading economic indicators are statistical data points that provide insight into the future direction of an economy. These indicators are used by analysts and policymakers to anticipate changes in economic activity before they occur.

Importance of Leading Economic Indicators

Understanding leading economic indicators is crucial for forecasting economic trends as they offer early signals of potential shifts in the economy. By analyzing these indicators, stakeholders can make informed decisions to mitigate risks or capitalize on emerging opportunities.

- One key importance of leading economic indicators is their ability to provide early warnings of potential economic downturns or upswings, allowing businesses and policymakers to adjust their strategies accordingly.

- They help in predicting changes in consumer spending, business investments, and overall economic growth, enabling stakeholders to prepare for future economic conditions.

- Leading economic indicators also offer valuable insights into the overall health of an economy, helping to assess the impact of policy decisions and external factors on economic performance.

Difference from Lagging Indicators

Unlike lagging indicators, which confirm trends that have already occurred, leading indicators provide signals about potential changes in the economy before they happen. This distinction makes leading indicators particularly valuable for proactive decision-making.

Types of Leading Economic Indicators

Leading economic indicators are crucial tools for forecasting future economic trends. They provide valuable insights into the overall health of the economy and help analysts make informed decisions. Here are some commonly used leading economic indicators:

Consumer Spending Patterns

Consumer spending patterns are a key indicator of economic strength. When consumers are confident about the economy, they tend to spend more on goods and services, leading to increased economic activity. On the other hand, a decrease in consumer spending can signal a weakening economy. Monitoring consumer behavior, such as retail sales and household expenditures, can provide valuable insights into future economic trends.

Stock Market Performance

The stock market is often considered a leading economic indicator due to its sensitivity to market conditions and investor sentiment. A rising stock market is typically associated with optimism about the economy, as investors anticipate higher corporate profits and economic growth. Conversely, a declining stock market can indicate concerns about the economy’s health and future prospects. Tracking key stock market indices like the S&P 500 or Dow Jones Industrial Average can offer valuable insights into the direction of the economy.

Impact of Leading Economic Indicators on Policy-Making

Leading economic indicators play a crucial role in guiding policymakers in making informed decisions that drive monetary and fiscal policies. These indicators provide valuable insights into the current and future state of the economy, helping policymakers anticipate changes and take appropriate actions.

Utilization of Leading Economic Indicators

Leading economic indicators are used by policymakers to assess the overall health of the economy and identify potential areas of concern. By analyzing these indicators, policymakers can determine the appropriate course of action to maintain economic stability and promote growth.

- One example of how changes in leading economic indicators influence policy-making is when a sharp increase in consumer spending is observed. This could signal a growing economy, prompting policymakers to consider adjusting interest rates to prevent overheating.

- Another example is the impact of a decline in housing starts on fiscal policies. If this indicator drops significantly, policymakers may implement measures to stimulate the housing market, such as tax incentives or subsidies.

Role in Government Strategies

Leading economic indicators play a crucial role in shaping government strategies for economic stability. By closely monitoring these indicators, policymakers can proactively address potential economic challenges and implement policies that support sustainable growth.

It is essential for policymakers to consider a combination of leading economic indicators to gain a comprehensive understanding of the economic landscape and make well-informed decisions.

Future Trends and Predictions

In looking ahead to 2024, there are several potential changes in leading economic indicators that we can anticipate. These changes may be influenced by global events, technological advancements, and emerging market trends.

Predicted Changes in Leading Economic Indicators

As we move into 2024, we may see shifts in leading economic indicators such as consumer confidence, housing starts, and business investments. Factors like inflation rates, interest rates, and employment numbers can all impact these indicators and signal changes in the overall economic landscape.

Impact of Global Events and Technological Advancements

Global events such as trade agreements, geopolitical tensions, and environmental crises can have a significant impact on leading economic indicators. Similarly, technological advancements in areas like artificial intelligence, automation, and renewable energy can also shape the economic outlook for the upcoming year.

Relationship Between Leading Economic Indicators and Emerging Market Trends

Leading economic indicators play a crucial role in understanding emerging market trends. By analyzing indicators like stock market performance, consumer spending, and manufacturing output, policymakers and investors can gain insights into the growth potential of emerging markets and make informed decisions based on these trends.

In conclusion, the realm of Leading Economic Indicators 2024 offers a glimpse into the intricate web that shapes economic predictions and policy decisions. By delving into this realm, individuals and policymakers alike can navigate the complexities of our global economy with newfound insight and foresight.

User Queries

How do leading economic indicators differ from lagging indicators?

Leading indicators anticipate future economic trends, while lagging indicators confirm trends that have already occurred.

Can consumer spending patterns really serve as reliable leading economic indicators?

Yes, as consumer spending is a significant driver of economic activity, changes in these patterns often signal shifts in the economy.

How do policymakers use leading economic indicators to shape monetary and fiscal policies?

Policymakers rely on these indicators to gauge the health of the economy and adjust policies accordingly to stimulate growth or curb inflation.