Delve into the realm of economics with a focus on the critical aspects of Inflation Rate and Economic Indicators. This exploration promises a deep insight into how these factors shape the financial landscape, offering a fascinating journey for readers.

Inflation rate and economic indicators play a vital role in understanding the health of an economy, influencing decision-making at various levels.

Inflation Rate

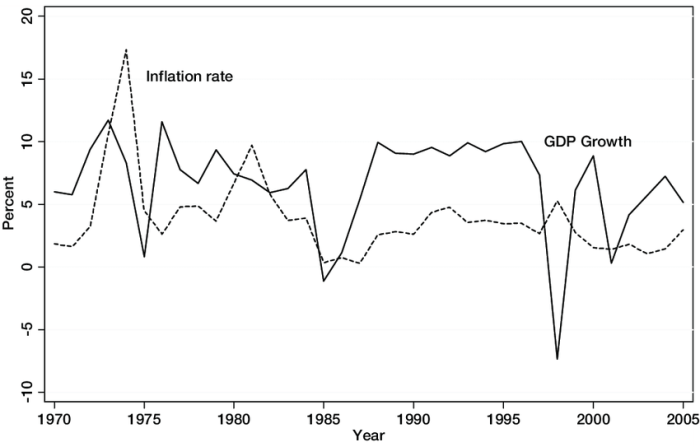

Inflation rate refers to the percentage increase in the general price level of goods and services over a period of time. It is a crucial economic indicator that reflects the rate at which prices are rising in an economy.

Calculation of Inflation Rate

The inflation rate is usually calculated using the Consumer Price Index (CPI). The formula for calculating the inflation rate is as follows:

Inflation Rate = ((Current CPI – Previous CPI) / Previous CPI) x 100

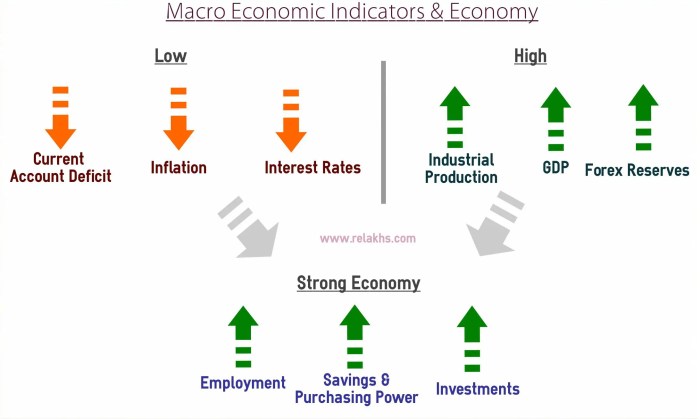

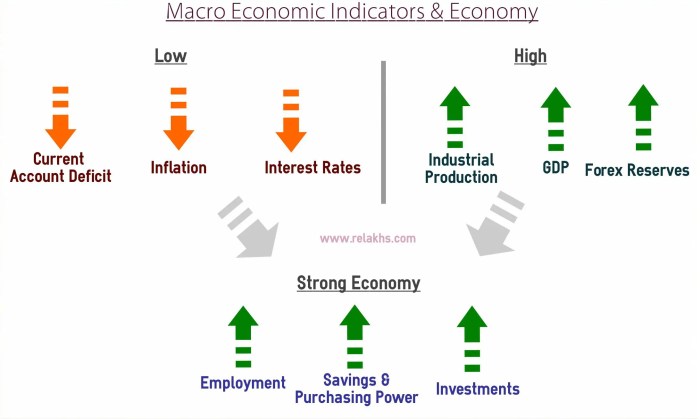

Impact of High and Low Inflation Rates

- High inflation rates erode the purchasing power of consumers, leading to a decrease in real income and savings. This can result in lower consumer spending and economic instability.

- Low inflation rates, on the other hand, indicate stable prices and can promote consumer confidence, investment, and economic growth.

Relationship between Inflation Rate and Interest Rates

Interest rates are often adjusted by central banks in response to changes in the inflation rate.

- High inflation rates may prompt central banks to raise interest rates to curb inflation and stabilize prices.

- Conversely, low inflation rates may lead to lower interest rates to stimulate economic activity and encourage borrowing and spending.

Economic Indicators

Economic indicators are data points that provide insights into the health and performance of an economy. These indicators are crucial for policymakers, investors, and analysts to assess the current state of the economy, make informed decisions, and predict future trends.

Types of Economic Indicators

- Leading Indicators: Leading indicators are signals that change before the economy as a whole changes. They are used to forecast future trends and provide early warnings of potential economic shifts. Examples include stock market performance, building permits, and consumer confidence.

- Lagging Indicators: Lagging indicators, on the other hand, change after the economy has started to follow a particular trend. These indicators confirm long-term trends and are useful in validating the direction of the economy. Examples include unemployment rate, inflation rate, and corporate profits.

- Co-incident Indicators: Co-incident indicators move in conjunction with the overall economy. They reflect the current state of the economy and are used to confirm the ongoing trends. Examples include GDP growth rate, industrial production, and retail sales.

Use of Economic Indicators

Economic indicators play a vital role in forecasting future economic trends by providing valuable insights into the current state of the economy. Analysts and policymakers use these indicators to make informed decisions, predict economic cycles, and identify potential risks and opportunities. By analyzing a combination of leading, lagging, and co-incident indicators, stakeholders can better understand the underlying factors affecting the economy and adjust their strategies accordingly.

In conclusion, the intricate dance between inflation rate and economic indicators unveils a compelling narrative of economic health and future trends. By grasping these concepts, individuals and policymakers can navigate the complex world of finance with greater clarity and foresight.

Question Bank

How does inflation rate impact the economy?

The inflation rate affects purchasing power, consumer spending, and investment decisions, ultimately influencing economic growth.

What are leading economic indicators?

Leading indicators provide insights into future economic trends, such as stock market performance and building permits.

Why is it important to analyze economic indicators?

Studying economic indicators helps in predicting economic trends, making informed decisions, and implementing appropriate policy measures.