Embark on a journey into the world of economic indicators, where data paints a vivid picture of the economy’s health and trends. From macroeconomic indicators to leading and lagging signals, discover how these metrics shape our understanding of the financial landscape.

ECONOMIC INDICATORS

Economic indicators are data points that provide information about the performance of an economy. They are essential tools for analyzing and understanding the current state and future trends of a country’s economic health.

These indicators can be categorized into three main types: leading indicators, lagging indicators, and coincident indicators. Leading indicators are signals that precede changes in the economy, while lagging indicators reflect the economy’s historical performance. Coincident indicators move in conjunction with the overall economy, providing real-time information.

Economic indicators play a crucial role in offering insights into the overall health of the economy. By monitoring these indicators, analysts, policymakers, and investors can assess the direction in which the economy is moving, make informed decisions, and develop strategies to mitigate risks or capitalize on opportunities.

Types of Economic Indicators

- Gross Domestic Product (GDP): Measures the total value of all goods and services produced in a country.

- Unemployment Rate: Indicates the percentage of the labor force that is unemployed and actively seeking employment.

- Inflation Rate: Reflects the rate at which prices for goods and services are rising.

- Consumer Confidence Index: Measures consumers’ optimism about the state of the economy.

- Industrial Production: Tracks the output of manufacturing, mining, and utilities sectors.

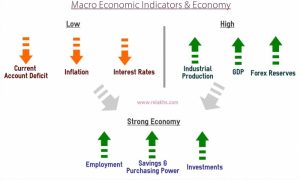

MACROECONOMIC INDICATORS

Macroecnomic indicators play a crucial role in providing a comprehensive view of the overall economic landscape of a country. These indicators help economists, policymakers, and businesses gauge the health of the economy, make informed decisions, and predict future trends.

Key Macroecnomic Indicators

- Gross Domestic Product (GDP): GDP measures the total value of all goods and services produced within a country’s borders in a specific period. It is a vital indicator of economic performance and growth.

- Inflation Rate: The inflation rate indicates the percentage increase in the general price level of goods and services over a period. High inflation can erode purchasing power, while deflation can signal economic stagnation.

- Unemployment Rate: The unemployment rate measures the percentage of the labor force that is actively seeking employment but unable to find work. It reflects the health of the labor market and overall economic conditions.

Impact of Changes in Macroecnomic Indicators

Changes in macroeconomic indicators can have far-reaching effects on various sectors of the economy. For example, a decrease in GDP growth rate could lead to reduced consumer spending and business investments. A high inflation rate may prompt the central bank to raise interest rates to control inflation, which can impact borrowing costs for businesses and consumers. Similarly, a rise in the unemployment rate can result in lower consumer confidence and decreased demand for goods and services, affecting businesses across different industries.

LEADING INDICATORS

Leading indicators are economic variables that are used to forecast future trends in the economy. They provide valuable insights into where the economy is headed and help analysts and policymakers make informed decisions. By analyzing leading indicators, experts can predict changes in economic growth or contraction before they actually occur.

Examples of Leading Indicators

- Building Permits: An increase in building permits is often seen as a positive sign for the economy, as it indicates future construction activity and investment.

- Stock Market Performance: The performance of the stock market is closely watched by economists as it can indicate investor confidence and overall economic health.

- Consumer Confidence: Consumer confidence measures the optimism consumers have about the state of the economy. High consumer confidence levels are usually associated with increased spending and economic growth.

LAGGING INDICATORS

Lagging indicators are economic indicators that follow an economic event or trend. They confirm the direction of the economy by reflecting historical data.

Examples of Lagging Indicators

- Unemployment Claims: Unemployment claims are a lagging indicator as they show the impact of economic conditions on job availability after the fact.

- Corporate Profits: Corporate profits are another lagging indicator that reflects the financial performance of companies after economic changes have occurred.

- Interest Rates: Changes in interest rates are considered lagging indicators as they react to economic conditions that have already taken place.

As we wrap up our exploration of economic indicators, remember that these data points offer valuable insights into economic trends and forecasts. By understanding the significance of these indicators, we gain a deeper understanding of the complex interplay of factors that drive our economy forward.

FAQ Section

How do economic indicators impact the economy?

Economic indicators provide crucial data points that analysts and policymakers use to assess the health of the economy, make informed decisions, and predict future trends.

What are some examples of leading indicators?

Leading indicators include metrics like building permits, stock market performance, and consumer confidence, offering early signals of potential economic shifts.

How do lagging indicators differ from leading indicators?

Lagging indicators, such as unemployment claims and interest rates, confirm trends after they have already occurred, providing retrospective insights into economic performance.